One might find it hard to believe that laundry, driver’s ed and athletic travel and equipment are considered “instructional costs” in Delaware public schools, but they are.

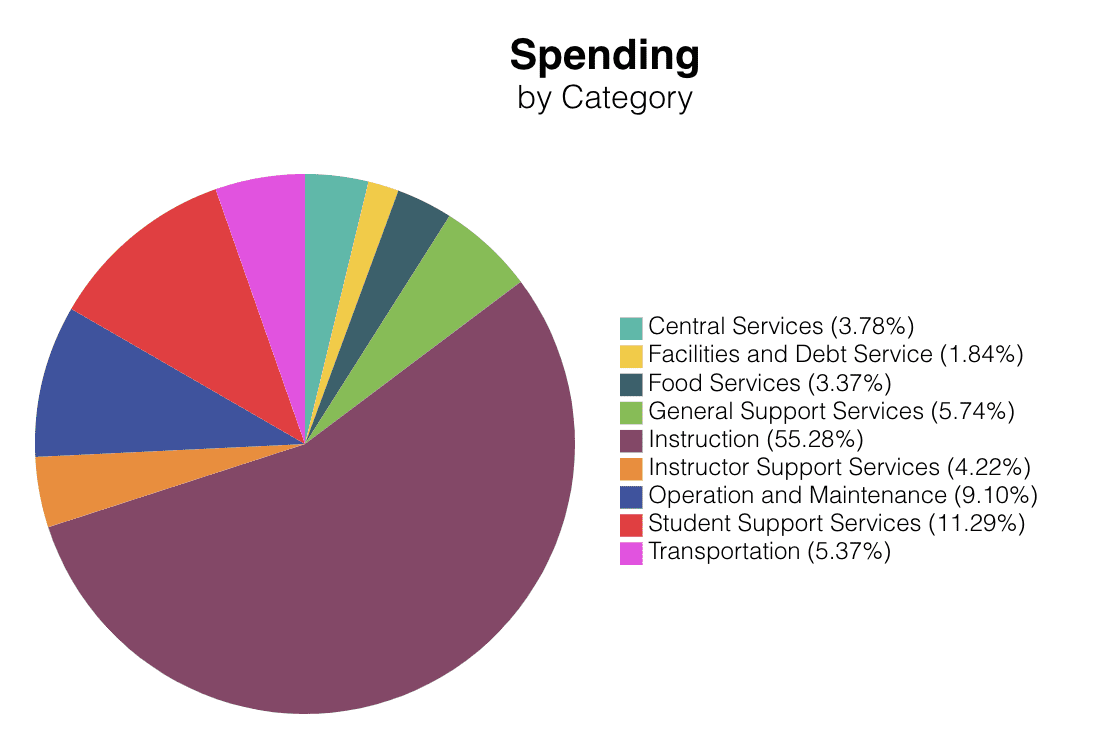

Instruction is one of nine categories of funding for the First State’s public schools.

It makes up 55.28% of the spending for the 23-24 school year, totaling $1,584,970,346, according to the Delaware State Report Card.

Some items included in instruction funding are to be expected: pay of teachers, substitutes, paraeducators; computers and technology; books and publications; multimedia equipment; and reading and math specialists.

“The pie chart on the state website shows sums, not averages, and all fund types (local, state, and federal) are included,” said Alison May, public information officer at the Department of Education. “It includes all local educational agencies (19 districts and all charters) where expenses were made in the respective categories.”

The definitions for each category of funding is pretty general. Instruction, for example, is defined as anything that “includes the activities dealing directly with the interaction between teachers and students.”

Britney Mumford, executive director of DelawareCAN, said her biggest takeaway from the funding splits is that it’s not granular enough.

Teacher salaries are assumed to be under instruction, “which is technically true, but also somewhat misleading,” Mumford said. “We want to know exactly how much money is being spent on salaries and exactly how much is going directly to student resources in the classroom., and this pie chart does not provide that information.”

Sara Hale, the chief operating officer at the Milford School District, pointed out that those categories were dictated by the federal government and the National Center for Education Statistics.

A few years ago, the state’s schools went through a whole re-coding process to map expenditures.

“So when you see those things, that’s because those are taken directly from expenditures in the First State Financial System based on how they were coded,” she said.

The coding for each expenditure – about 600 different codes – can be found on a master excel sheet here under “Financial Coding Guidance.”

“All of our teachers obviously are coded to instruction, but if there are student support supervisors or something, they may be educators but not direct classroom teachers,” she said. “So when it says ‘student support services,’ those are most likely mental health professionals, those could be additional counselors, those could be other folks supporting special education.”

She agreed with Mumford that it would be more digestible and meaningful to the public if the context behind the percentages, as well as the percentages within the different categories, were published.

Hale also noted that the categories have a lot of overlapping expenditures, as shown with student field trips.

“The coding is based on federal guidance for each federal reporting category,” May said. “A team of chief financial officers, Department of Education staff and the Division of Accounting worked on this [pie chart] a few years ago to ensure alignment with those federal rules.”

District administrators are listed under ‘general support services’

“There could be pieces of that in central services, there could be pieces in general support, there could be pieces in instructor support,” Hale said. “Support services provide administrative, technical, logistical support to facilitate enhanced instruction, so those may be considered instructional expenses because it is administrative, like the building principals would likely be under instruction.”

Mumford said because there is no policy that says how this is presented to the public from year to year and there’s no continuity. The public doesn’t really know what falls into each category.

The recent report on Delaware’s funding formula from the American Institutes for Research that recommended the state to invest between $500 million and $1 billion more into public education while shifting funding towards a focus on student needs, could have an impact as well.

RELATED: Adding $500M+ more into education likely matter for legislature

“I would expect that if they were to incorporate some of the recommendations that we would see the piece of the pie dedicated to instruction increase,” Mumford said. “If we move to a weighted student funding formula, in theory, we would be spending more money directly on student resources inside the classroom and the specific needs of individual students, which would cause that piece of the pie to be larger.”

She would also expect the amount of funding for transportation to also increase.

“I know that’s a strange thing to say, but a lot of parents that are choicing either into other school districts or are utilizing charter school options. In some of our more southern districts, families don’t have additional options within their immediate geographical area,” she said, “and if we were able to provide them funding to transport their students further, we increase the number of options that families have.”

Here are the total funding amounts for categories other than instruction, and what’s included in each:

Student support services – $323,802,287

This is funding for activities designed to assess and improve the wellbeing of students and to supplement the teaching process.

Operation and maintenance – $260,922,209

This is funding for activities concerned with keeping the physical plant open, comfortable, and safe for use and with keeping the grounds, buildings and equipment in effective working condition and state of repair.

General support services – $164,493,621

This is funding for activities concerned with establishing and administering policy for operating the school district and activities that are financed and operated in a manner similar to private business enterprises, where the stated intent is to finance or recover the costs primarily through user charges.

Transportation – $154,099,757

This is funding concerned with conveying students to and from school, as provided by state and federal law. These include trips between home and school and trips to school activities.

However, transportation for field trips is coded under student travel which is part of the “instruction” category on the pie chart.

It is unclear why athletic travel isn’t included in transportation, since it’s extracurricular and has nothing to do with classes.

Instructor support services – $121,039,959

This is funding for activities associated with assisting the instructional staff with the content and process of providing learning experiences for students.

Central services – $108,504,503

This is funding for activities that support other administrative and instructional functions, including fiscal services, human resources, planning and administrative information technology.

Food services – $96,617,460

This is funding for activities concerned with providing food to students and staff in a school or school district.

Facilities and debt service – $52,800,733

This is funding for activities concerned with acquiring land and buildings; remodeling buildings; constructing buildings and additions to buildings; initially installing or extending service systems and other built-in equipment; improving sites, servicing the long-term debt of the school district, including payments of both principal and interest.

It somewhat acts like a credit card where districts will pay off land, buildings and more over time.

Raised in Doylestown, Pennsylvania, Jarek earned a B.A. in journalism and a B.A. in political science from Temple University in 2021. After running CNN’s Michael Smerconish’s YouTube channel, Jarek became a reporter for the Bucks County Herald before joining Delaware LIVE News.

Share this Post